Canadians, Brace for Impact

You might wonder how the incoming U.S. tariffs affect you and why you should care. But if Canada’s leaders seem on edge, that should tell you something— it’s serious. The countdown is on, and with February 1st approaching, tariffs aren’t just a distant threat anymore—they’re a very real and immediate problem.

Whether they take effect immediately or the wheels are merely set in motion, Canadians must be ready. These tariffs won’t just shake up trade policy—they’ll hit households, businesses, and the economy at large, bearing in mind that Canada’s exports to the U.S. are worth about 20% of the size of the Canadian economy.

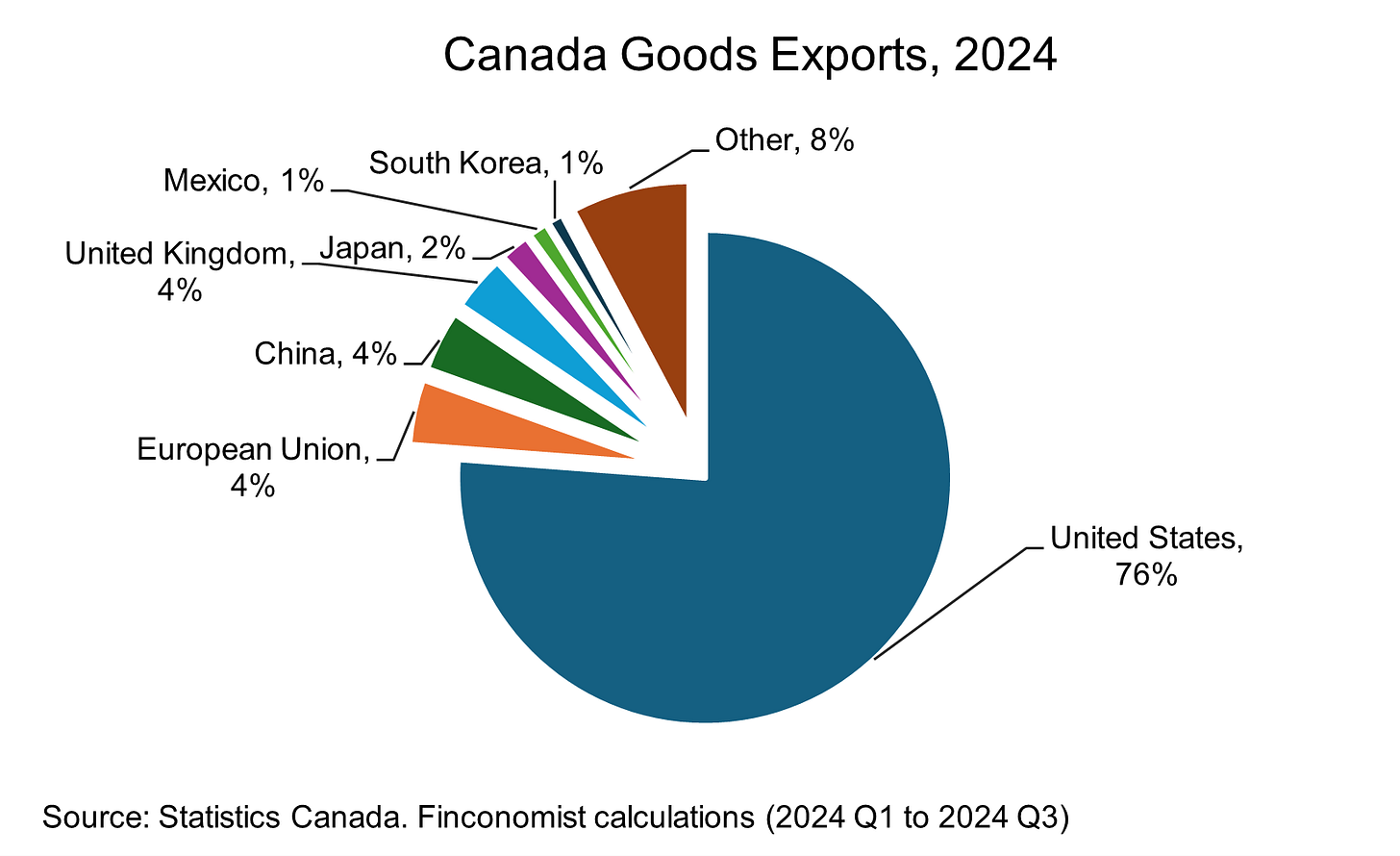

While Canada and the U.S. are each other’s biggest export markets, Canada is much more exposed to tariffs imposed on it by the U.S. as the country sells 76% of its goods exports to the U.S., while the U.S. exports less than 17% of its goods to Canada. The implication of that being that threats of retaliation will not deter a determined Trump.

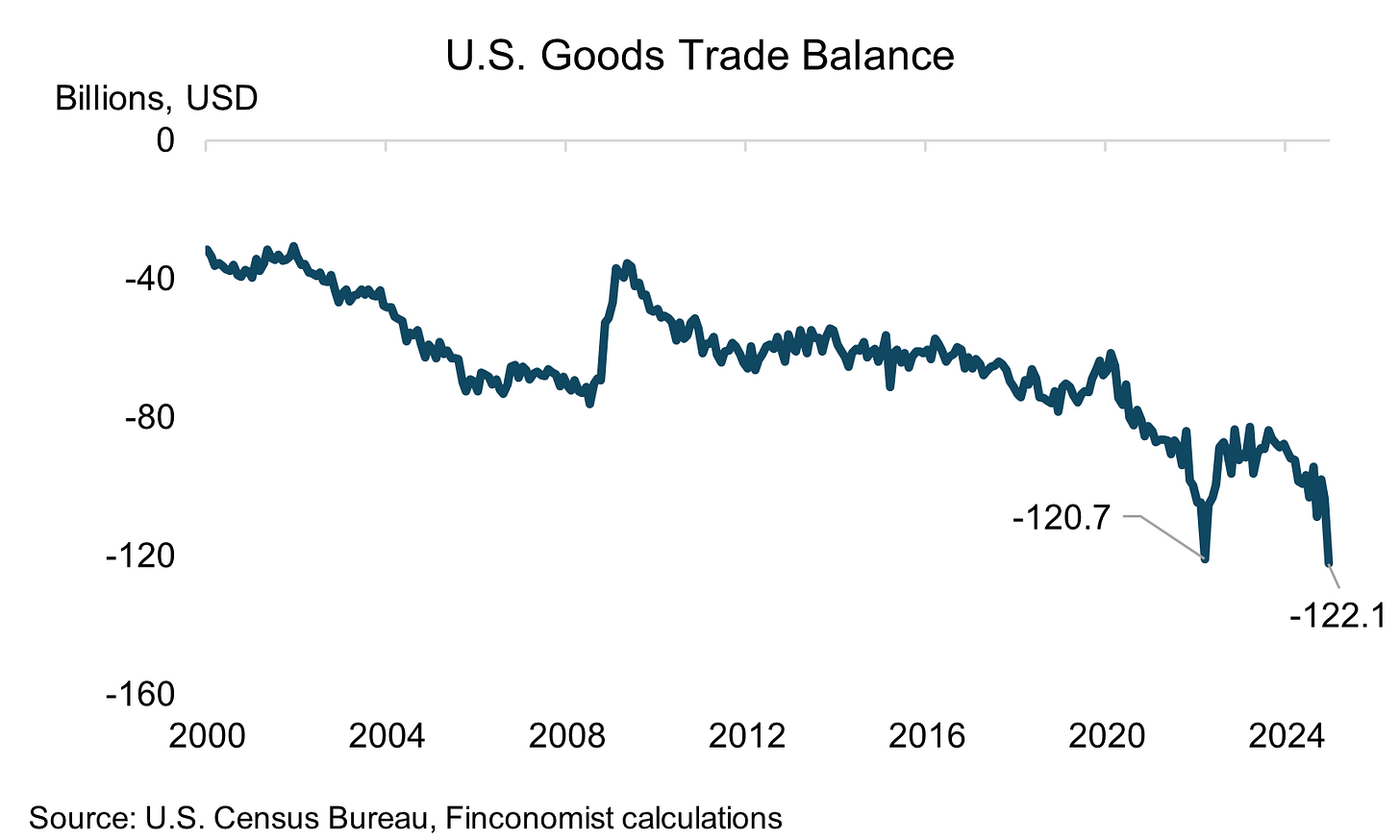

As Canada tries to meet U.S. demands to tighten border security given how devastating a 25% tariff on 76% on its exports will be, it is quickly becoming evident that Trump’s motives go beyond border security. He has been pretty open about what really bothers him— the trade deficit, the fact that the U.S. buys more from Canada than it sells.

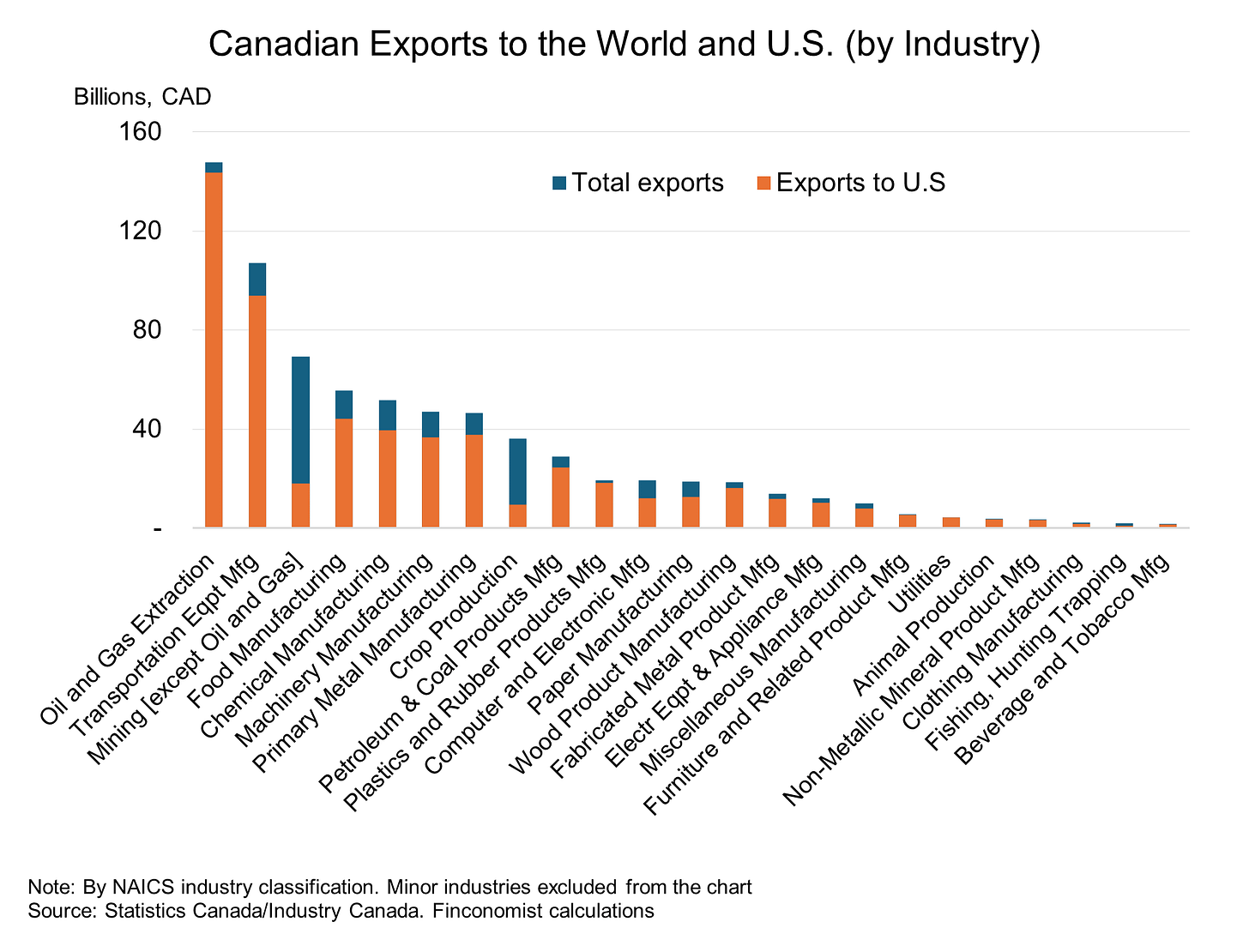

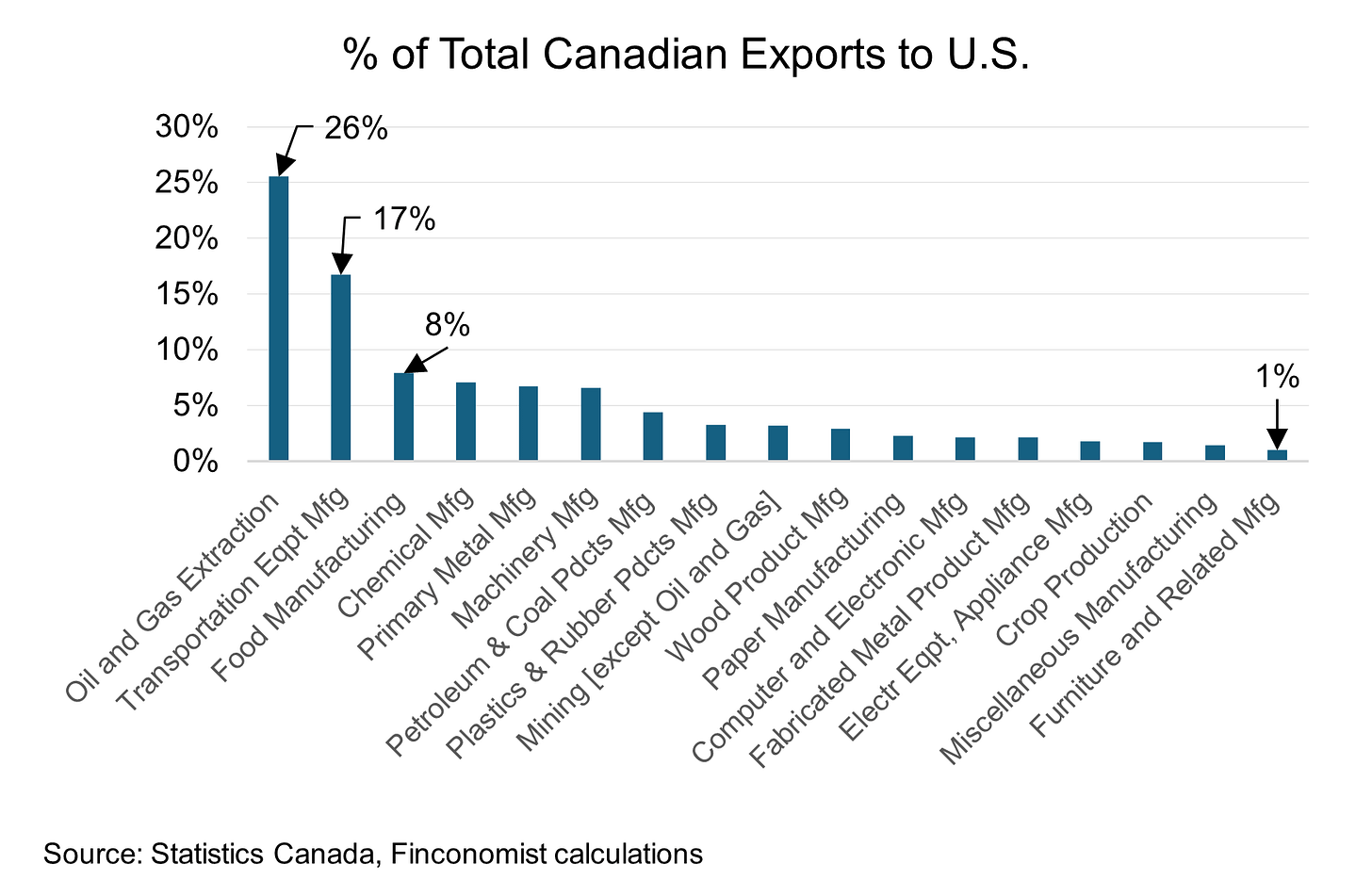

Canada’s biggest export to the U.S. is energy products. And while the U.S. is the world’s top oil producer, it doesn’t produce enough to meet its own demand. In 2024 (through November), the U.S. imported 2.2 billion barrels of crude oil, with 63% coming from Canada and another 7% from Mexico, according to the U.S. Census Bureau. In other words, a big chunk of the trade deficit that frustrates Trump exists because Canada is supplying a resource America needs. How Trump has come to interpret this as giving “massive subsidies to Canada” is left to anyone to try to determine.

As if the world (and Canada) needed more data to anger Mr. Trump, recently released data on the U.S. goods trade deficit showed that the trade deficit reached a record level in December possibly due to people front-running tariffs. The data release shows U.S. imports rising 3.9% and exports falling 4.5%.

To most, it is hardly a surprise that a prosperous, high-consumption economy like the U.S.—nearly ten times the size of Canada—buys more from its resource-rich neighbor than it sells. But that doesn’t seem to matter. Even if tariff threats are being used by Trump as a negotiation tactic as some believe, it still bears being worried that tariffs will in fact be imposed for at least some period of time.

A weak-er loonie

Canadians who have recently visited the U.S. likely felt the sting of the weak loonie. As if paying 1.44 Canadian dollars per USD was not painful enough, Trump’s 25% tariff is expected to weaken the loonie even more. Some economists predict the exchange rate could slide to $1.60 CAD/USD making everything from cars and food to vacationing in the U.S. more expensive.

The same goes for machinery used in business production which are among Canada’s main imports from the U.S. This has far reaching consequences since increase in the cost of capital goods used in making products will reduce Canadian business investment, and ultimately lead to job losses.

With that said, since a weaker currency makes Canadian goods cheaper for U.S. buyers, it could help offset some of the impact of tariffs. Some industries with export markets outside the U.S. will also benefit from a weaker loonie as it will make their products more competitive globally, however, it is important to point out how few winners there will be.

Rocky road ahead for Canadian Businesses

Considering what constitutes the bulk of Canadian exports to the U.S., the hardest hit industries will be the oil and gas sector and the auto industry. You’d think the oil sector would be safe—since the U.S. relies heavily on Canadian energy and higher prices would spark backlash from American consumers. But according to Trump, even oil could be subject to 25% tariff.

Many continue to hold on to the belief that oil will be spared from tariffs, but there’s no such optimism for the auto industry. As auto parts typically cross North American borders multiple times during their production phase due to highly integrated supply chains, if tariffs are imposed at each U.S. border crossing, costs will skyrocket dealing a strong blow to Canada’s auto industry.

The auto sector won’t be the only one feeling the squeeze. Across industries, Canadian businesses will have to decide how to handle the added costs—either by lowering prices to stay competitive or passing the tariffs onto U.S. buyers. Either way, exports will take a hit, business profits will shrink, and job losses will follow.

An Exodus?

With the options being to pass on the import tax to U.S. importers and American consumers and risk losing customers, or to take on all or some of the tariffs thereby decreasing their own profits, some Canadian producers may find it easier to relocate their business across the border to the U.S., taking their jobs along with them.

Consumer and Business confidence shot

Given the amount of uncertainty around these tariffs—whether they’ll happen, how they’ll be enforced, and what they’ll mean for the economy—consumer confidence which is already shaken by elevated post-pandemic prices and a weak job market, will likely take another hit.

We have seen some of this play out, although there is likely more to come. Confidence dropped significantly in November and December last year after Trump announced plans to impose 25% tariffs on imports from Canada.

When consumer confidence is low, households spend less and save more, causing business profits to decline. At the same time, low business confidence will also play a part in slowing economic growth as businesses hold off on making investments, expanding operations or hiring workers.

The household struggle continues: a resurgence of inflation, a recession, or both

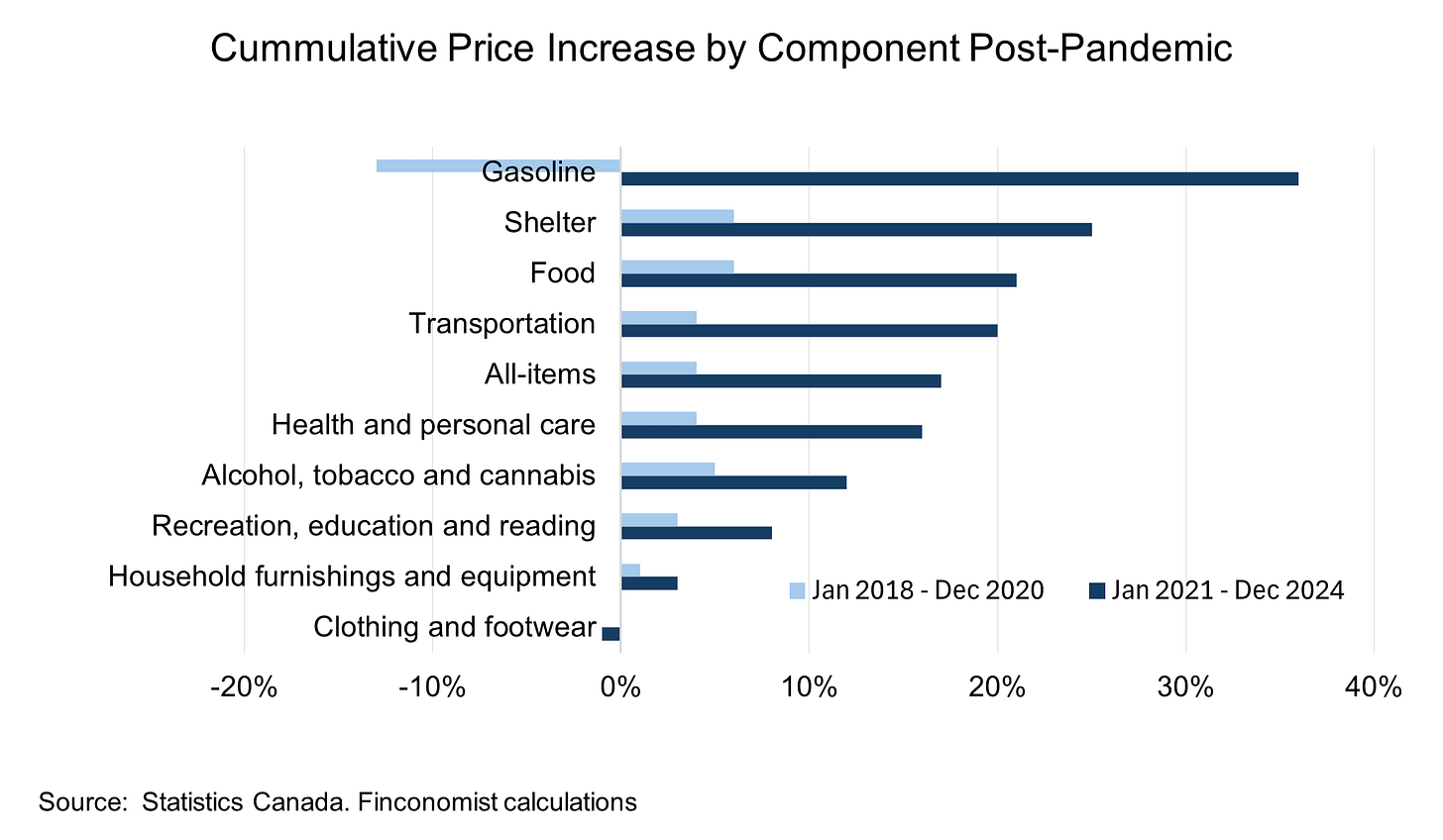

With many households still reeling from the significant rise in prices that came after the pandemic despite wages also rising, it looks like things could get worse.

Tariffs will weaken the loonie making U.S. imports more expensive, raising prices for businesses and Canadian families on several things from food to machinery. If Canada retaliates, tariffs placed on U.S. imports will cause a further rise in prices. Note that 62% of Canadian imports come from the U.S, and so far, both conservative and liberal candidates have communicated a strong willingness to retaliate.

The combined effect of a sustained 25% tariff and retaliatory tariffs will likely push Canada into a recession. Higher prices of imported goods will reduce household disposable income and business profits. With lower household spending and business profits, unemployment will likely rise as businesses lay off workers to cut costs.

It is probably fair to say the Bank of Canada is also grappling with the uncertainty surrounding tariffs and their impact. Considering the combined effect of a weakening economy (which calls for lowering interest rates) with rising prices and a weakening currency (both of which call for raising rates), and given the lessons learnt from their response during the pandemic, they may be less keen to act one way or the other.

As if there was not enough to consider, the effect of interest rate decisions on homeowners will also likely be of interest. Over 2025 and 2026, a significant number of mortgages will come up for renewal in what has been described as the mortgage renewal wall.

CMHC reports that 1.2 million mortgages are coming up for renewal in 2025 and at least 85% of these mortgages were obtained when the policy interest rate was 1%. For these group of people, some of whose jobs may also be affected by tariffs directly or indirectly, the decision to hold rates steady or raise them could have serious consequences.

The possibility of the Canadian government providing support to individuals and businesses whose income will be affected by tariffs has been floating around, but if the tariffs are as broad as threatened, the government, hindered by the goal of keeping debt and deficits low, may have very limited budgetary capacity to provide these supports.